Affordability has quietly become one of the most urgent crises facing the United States. From rent and groceries to healthcare and utilities, the basic cost of survival is rising faster than wages, disability benefits, and fixed incomes. For tens of millions of people, the question is no longer how to save money—it’s how to survive.

Search interest in the term “affordability” has surged in recent weeks reflecting a growing public desperation over the skyrocketing cost of living. While politicians debate economic indicators, everyday Americans are choosing between rent and medicine, groceries and gas, heat and food.

- Housing Costs Are Breaking the System

- Food Prices Are Forcing Families to Go Without

- Healthcare is Still a Luxury in the Richest Nation on Earth

- Energy and Utility Costs are Pushing People Into Hard Choices

- Fixed-Income Americans Are Being Left Behind

- Affordability is a Social Justice Issue

- What Comes Next?

- Final Thought

This is what the affordability crisis really looks like.

Housing Costs Are Breaking the System

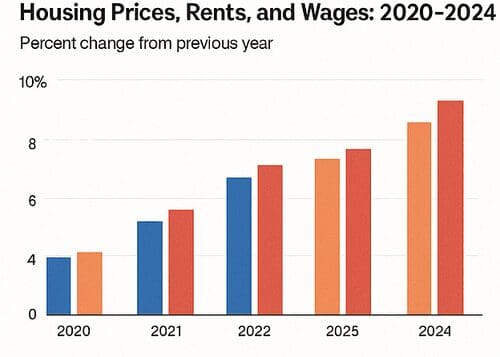

Housing is now the single largest driver of financial instability in the U.S.

- Rents have surged nationwide over the past several years.

- Private equity firms buy all the single-family homes in an area, then turn around and rent them at high prices—deiving up the cost of housing in that area.

- The lack of homes available in to purchase, or “inventory,” is another issue causing the crisis.

- Home prices remain out of reach for most first-time buyers. The median age of a first-time home buyer in 2025 is 40, up from 38 in 2024.

- Wages have not kept pace with housing inflation.

For low-income workers, seniors, and people with disabilities, housing costs often consume 50% to 80% of monthly income—far above what financial experts consider sustainable. Once rent is paid, there is often little left for food, healthcare, or emergencies.

Housing instability is now directly linked to:

- Rising homelessness

- Increased domestic stress and health problems

- Higher rates of forced relocation and displacement

Food Prices Are Forcing Families to Go Without

Grocery prices remain significantly higher than they were before the pandemic. While inflation numbers may fluctuate month to month, the reality at the checkout counter hasn’t improved for most households.

Families are reporting:

- Skipping meals

- Cutting fresh produce

- Relying on food banks despite working full-time

- Replacing healthy foods with cheaper, processed options

Food insecurity is no longer confined to the unemployed. It now affects:

- Full-time workers

- Seniors on Social Security

- Disabled Americans living on fixed monthly benefits

Healthcare is Still a Luxury in the Richest Nation on Earth

Despite political promises and reform efforts, healthcare remains unaffordable for millions of Americans.

- Insurance premiums continue to rise. Obamacare premiums are expected to increase up to 5 times the current rates in 2026.

- Deductibles are often thousands of dollars

- Prescription drug prices remain crushing

- Many people avoid care due to cost

For people with chronic illnesses, mental health conditions, or disabilities, the affordability crisis is not abstract—it’s life-altering.

Skipping medication, delaying care, or avoiding treatment altogether has become routine for people who simply cannot afford to stay alive in the U.S. healthcare system.

Energy and Utility Costs are Pushing People Into Hard Choices

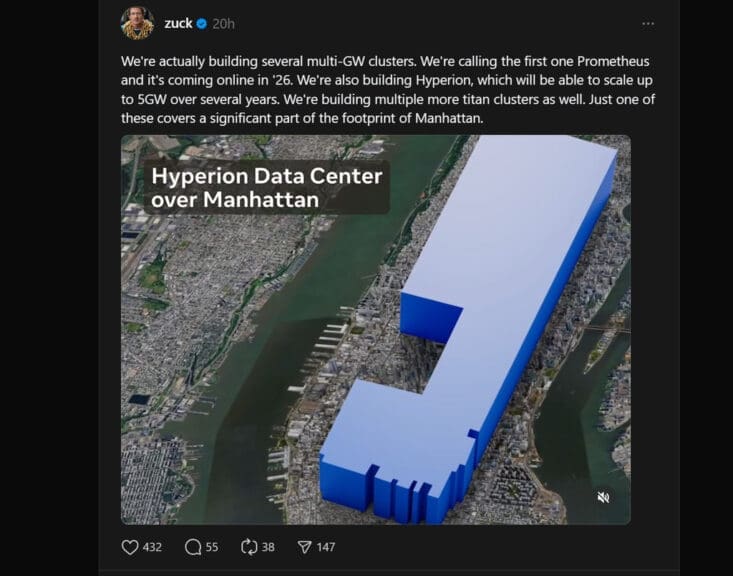

Heating, cooling, electricity, and water are now major financial stressors—especially as global warming increases temperature extremes. Massive AI data centers are being constructed all over the country. Americans have started protesting proposed construction of data centers in their community after reports came out showing how sharing an electric grid with a data center results in skyrocketing electricity costs

Many households are forced to choose between:

- Paying utilities

- Buying food

- Filling prescriptions

Utility shutoffs disproportionately impact:

- Low-income families

- Seniors

- Disabled individuals

- Renters

And yet, access to energy is treated as a privilege rather than a basic human necessity.

Fixed-Income Americans Are Being Left Behind

Perhaps no group is hit harder by the affordability crisis than people on fixed incomes.

That includes:

- Social Security recipients

- Disability benefit recipients

- Veterans

- Retirees

Monthly benefits were never designed to keep up with:

- Rapid housing inflation

- Food price surges

- Healthcare cost explosions

For many, survival now depends on sacrifice, debt, charity, or assistance programs that are already overwhelmed.

Affordability is a Social Justice Issue

Affordability is not just an economic issue—it is a human rights issue.

When people cannot afford:

- Shelter

- Food

- Healthcare

- Energy

They are denied dignity, stability, safety, and opportunity.

The burden does not fall equally. The affordability crisis disproportionately harms:

- Women

- People of color

- LGBTQ+ individuals

- Disabled people

- Immigrants

- Single parents

Corporate profit growth continues while public survival becomes harder. That is not a market failure—it is a policy failure.

What Comes Next?

The growing public attention on affordability reflects a breaking point. People are no longer quietly absorbing these costs. They are naming the problem—and demanding accountability.

Real solutions will require:

- Housing protections and rent stabilization

- Universal healthcare access

- Living wages tied to inflation

- Stronger consumer protections

- Expanded social safety nets

Until then, millions of Americans will continue to live one bill away from disaster.

Final Thought

Affordability is now the defining economic issue of our time—not because people are irresponsible, but because the system has been structured to extract more while giving less.

At Resist Hate, we believe surviving should never be this expensive.