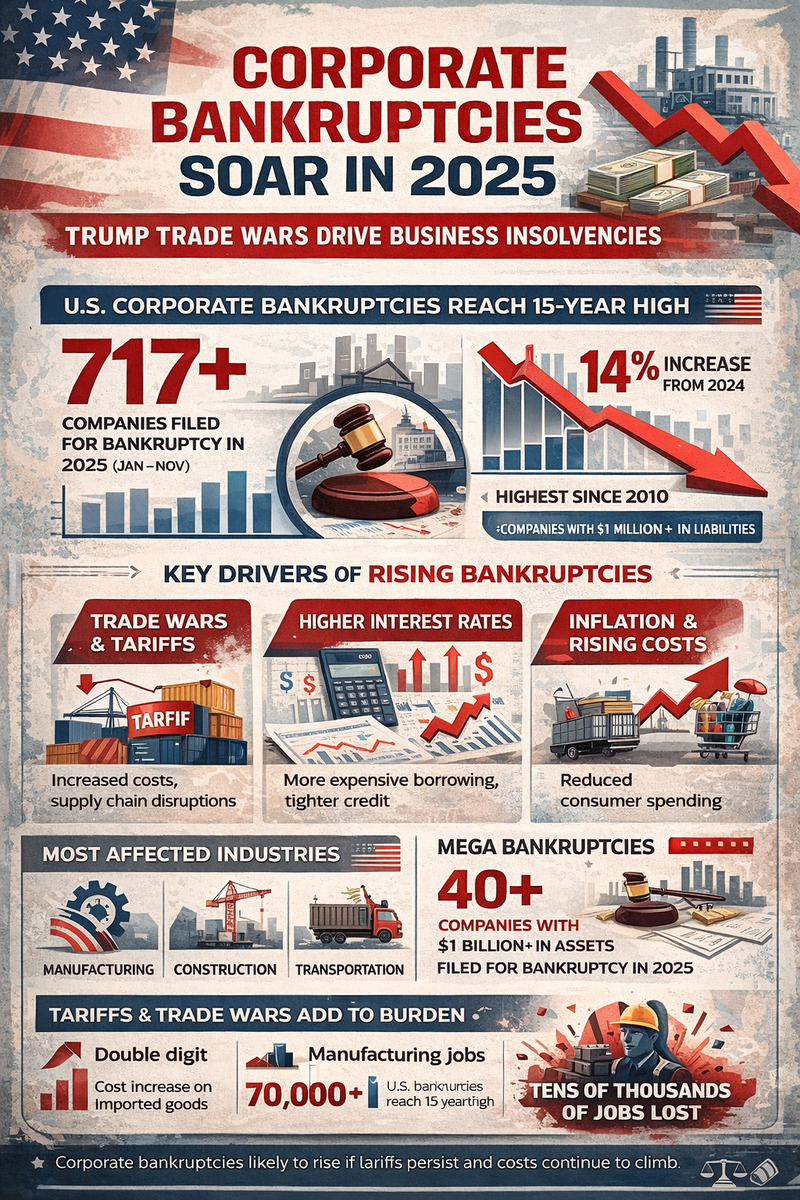

In a striking sign of uneven economic pressure across the United States, corporate bankruptcies surged to their highest level in 15 years in 2025, with at least 717 companies filing for bankruptcy protection between January and November. These numbers mark a roughly 14 percent increase year-over-year and the most such filings since the aftermath of the 2010 recession.

While the broader U.S. economy posted solid GDP growth during the same period, the wave of insolvencies reveals frictions beneath the surface — where rising costs, shifting federal policy and volatility in supply chains are pushing companies to the brink.

Trade Policies and Tariffs Inflate Costs

A key factor cited by many struggling companies is the ongoing impact of the Trump administration’s aggressive trade war policies and tariff regime.

President Trump claims his tariffs are used as protectionist measures, aimed at strengthening U.S. manufacturing and reducing trade deficits, but they have instead increased the cost of imported inputs for many businesses — particularly those that are import-dependent or operate in global supply chains.

He also continues to repeat the false claim that foreign companies are paying the tariffs, when they are a tax on consumers. When he brags about his tariffs bringing billions into the country, he’s bragging about the amount of money that has been paid by Americans.

Economists note that tariffs on materials and components, including solar products, have imposed substantial cost pressures on firms that lack the pricing power to pass those costs onto consumers.

For example, a solar-panel company that filed for Chapter 11 cited tariff-related cost increases and reduced tax incentives as key drivers in its financial collapse.

Jeffrey Sonnenfeld, a management professor at Yale University, observed that companies are absorbing these added expenses rather than hiking prices, in an effort to remain competitive with cost-conscious consumers.

However, that strategy is unsustainable for businesses with narrow margins, leading more to insolvency.

A Broad Swath of Industries Under Strain

Bankruptcy filings in 2025 were not limited to small businesses or niche industries. Large “mega bankruptcies” — filings by companies with more than $1 billion in assets — also climbed significantly, reflecting strain at the highest levels of corporate America.

The spike in bankruptcies was most pronounced in industrial sectors, including manufacturing, construction and transportation — all sectors that are heavily affected by tariff costs and supply-chain disruptions.

These industries also reported job losses, with manufacturing alone shedding tens of thousands of positions over the past year.

Meanwhile, consumer-oriented companies offering discretionary goods and services — from fashion and home goods to travel-related services — also saw elevated bankruptcy rates as inflation, higher interest rates, and reduced consumer spending weighed on sales.

Contrasts Between Growth and Reality

The broader U.S. economy recorded a strong GDP performance, but this aggregate growth masks a more complicated picture. While headline figures reflect consumption spending and investment in sectors such as technology, many traditional industries are struggling under the weight of elevated costs and shifting demand.

The GDP, gross domestic product, is made up of several different economic factors:

Experts caution that what looks like macroeconomic strength on paper can obscure pockets of weakness that threaten long-term business success. Companies without the ability to adjust prices or control input costs face narrowing margins and mounting debt, which often culminates in Chapter 7 or Chapter 11 bankruptcies.

The Trump Administration’s Perspective

The White House has defended the tariffs and trade policies, arguing they are beneficial for national security and have helped shrink the trade deficit while supporting domestic industry. In reality, the President has been using tariffs as a “punishment” to force countries to do what he wants.

For example, Trump put 50% tariffs on Brazil when the government and Supreme Court both refused to end the prosecution of their former President, Bolsonaro, who engaged in an insurrection similar to what occurred on January 6th in the U.S.

In late October of this year, Congress passed legislation to remove the excessive tariffs on Brazil. President Trump’s unpredictability and instability are causing distrust of the U.S. among our allies.

Social media statements from the President claim strong GDP figures and reduced deficits as evidence of success. Recently, he’s been pushing the Supreme Court to side with the administration in the tariffs case.

However, critics maintain that the costs of tariffs — particularly for smaller and mid-sized companies — can outweigh these benefits, especially when retaliatory measures from trading partners disrupt export markets.

Recovery for sectors such as manufacturing and energy remains uneven, with policy shifts continuing to play a major role in business outcomes.

What This Means for the Future

As U.S. policymakers and business leaders grapple with the rise in bankruptcies, the 2025 trend underscores the complex interplay between public policy and private enterprise.

With continued tariff pressure, high borrowing costs, and evolving global trade dynamics, the corporate landscape is likely to remain turbulent in the near term.

Companies that adapt through innovation, diversification of supply chains, and strategic cost management may weather these challenges better than those tied to rigid models. In a world of shifting economic currents, adaptability is proving to be as critical as resilience.